Govt Waives Off Debit Card Charges, Doubles e-Wallet Limit To Rs 20,000

After two weeks of demonetization, government excused farmers from note ban, allowing them to borrow seeds with old 500 rupee notes. Addition to this, certain relaxation measures were included such as withdrawal up to Rs 25,000 per week from their bank accounts if there is any marriage event.

Meanwhile, Agricultural traders were allowed to withdraw Rs 50,000 in a week for the further smooth process.

Though many controlling measures were taken to simplify the issue at common man’s level, the withdrawal limit is decreased to Rs 2000 from Rs 4500 per week.

The instant impacts of demonetization are quite adverse in the very mean period of time, however, it has vital long-term benefits. Facebook and Twitter were flooded with never ending queue photographs and the opposition parties raised their voices clinching to the common mans’ problems.

Many fundamental and beneficiary moves were made by the government to ensure the absence of recession in currency supply.

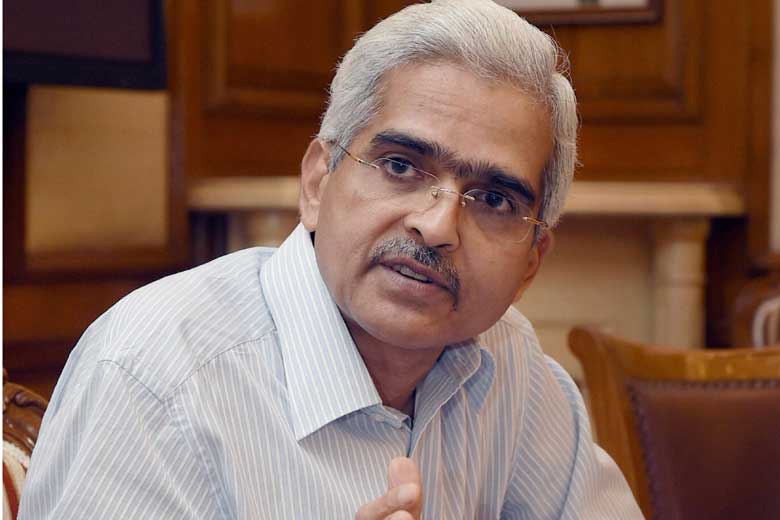

The Secretary of Ministry of Economic Affairs addressed media on further measures taken by Finance Ministry

That include:

- No service charge on the use of debit cards. Public banks and a few private banks will waive the charge: DEA Secy Shaktikanta Das

- Railways will waive service charges on e-ticket booking till Dec 31: DEA Secy

- RBI doubles e-wallet limit to Rs 20,000: DEA Secy.

- According to DEA Secy, public banks have informed him that there has been a surge in demand for usage of digital financial transactions.

- No service charge will be levied on digital financial transactions using feature phones till December 31st: DEA Secy

- Economic Affairs Secy said 82,000 ATMs have been re-calibrated so far and the rest of them will be re-calibrated within few days.

- National Bank for Agriculture and Rural Development and Reserve Bank of India have been advised to ensure adequate cash supply is available to the District Central Cooperative Banks: Shaktikanta Das

- NABARD has sanctioned Rs 21,000 crore limit to DCCBs: Shaktikanta Das

- These measures are aimed at mitigating the distress resulting from the government’s move to demonetise Rs 500 and Rs 1,000 notes.