New SBI Rules To Be Implemented From April 1st, Here’s What You Need To Know!

A few days ago, private banks like Axis Bank, HDFC and ICICI announced charges on the cash transactions. Now the State Bank of India (SBI) has also come up with revised plans after a gap of five years.

Yes, the State Bank of India has revealed a list of charges that it will be levying from April 1st.

From April 1, SBI will be charging a penalty on non-maintenance of minimum balance on accounts. The fees will also be revised on ATM transactions and other services.

With the Reserve Bank permit, SBI has decided to levy charges for breaching the minimum balance limit. The bank had suspended levying charges on breach of minimum balance requirements in 2012.

Here are all the new charges that will come into existence from April 1:

-

From April 1, SBI will permit savings bank account holders to deposit cash three times a month free of charge. Beyond that, it will charge Rs 50 plus service tax for every transaction.

-

For current account holders, the cash transaction charges can be as high as Rs 20,000

-

The bank account holders will have to maintain a minimum balance or Monthly Average Balance (MAB)

-

The failure to maintain Monthly Average Balance (MAB) in accounts will call for a penalty between Rs 50 to Rs 100 plus service tax per month.

-

The charges and MAB will vary according to the location of the bank. It is minimum in case of rural branches.

-

In metropolitan cities, If the amount is below 75% of the Monthly Average Balance (MAB), the charges levied will be Rs 100 plus service tax. If the amount is 50 percent or less of the MAB, then the fees levied will be Rs 50 plus service tax. These charges differ in case of rural branches.

-

Withdrawal of cash from ATMs will attract a charge of up to Rs 20 if the number of transactions from ATMs of other banks exceeds three and Rs 10 for more than five withdrawals from SBI ATMs.

-

There will be no charge on withdrawals from SBI ATMs if the account holder maintains a minimum balance of Rs 25,000. Incase of withdrawals from ATMs of other banks, there will be no charge if the balance exceeds Rs 1 lakh.

-

SBI will charge Rs 15 for SMS alerts per quarter from debit card holders who maintain an average quarterly balance of up to Rs 25,000 during the three months. There will be no charge for UPI/USSD transactions of up to Rs 1,000.

-

For Unified Payments Interface (UPI) and Unstructured Supplementary Service Data (USSD), there will be no charge for transactions of up to Rs 1000.

As of now, monthly average balance (MAB) for a savings bank account is Rs 500 without facility of cheque book and Rs 1,000 with cheque-book across the country.

But, India’s largest bank has now decided to fix separate MABs for ‘metro’, ‘urban’, ‘semi-urban’ and ‘rural’ areas from the beginning of next financial year i.e from this April 1st.

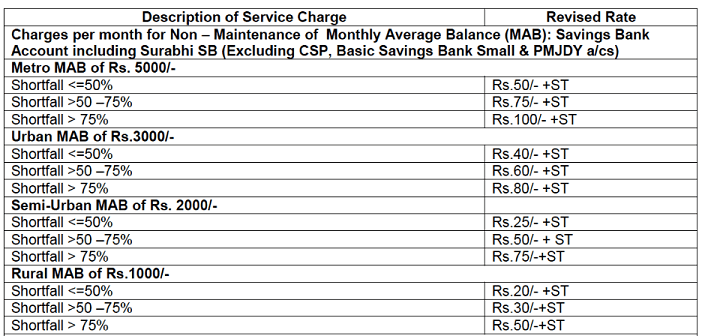

Charges for Non-maintenance of Monthly Average Balance (MAB)

Further details are:

The Monthly Average Balance of Rs 5000 in a branch in Metropolitan City then:

- Shortfall <=50% = Rs 50/- + Service Tax.

- Shortfall >=50-75% = Rs 75/- + Service Tax.

- Shortfall > 75% = Rs 100/- + Service Tax

The Monthly Average Balance of Rs 3000 in a branch in the Urban area then:

- Shortfall <=50% = Rs 40/- + Service Tax

- Shortfall >=50-75% = Rs 60/- + Service Tax.

- Shortfall > 75% = Rs 80/- + Service Tax

The Monthly Average Balance of Rs 2000 in a branch in the Semi- Urban area then:

- Shortfall <=50% = Rs 25/- + Service Tax

- Shortfall >=50-75% = Rs 50/- + Service Tax.

- Shortfall > 75% = Rs 75/- + Service Tax.

The Monthly Average Balance of Rs 1000 in a branch in the Rural area then:

- Shortfall <=50% = Rs 20/- + Service Tax

- Shortfall >=50-75% = Rs 30/- + Service Tax.

- Shortfall > 75% = Rs 50/- + Service Tax

What’s your take on this? Let us know your views in the comments section below.

H/t & Source: Hindustan Times