Public Distrust Overbank Deposit, The Government Decided To Drop The FRDI Bill

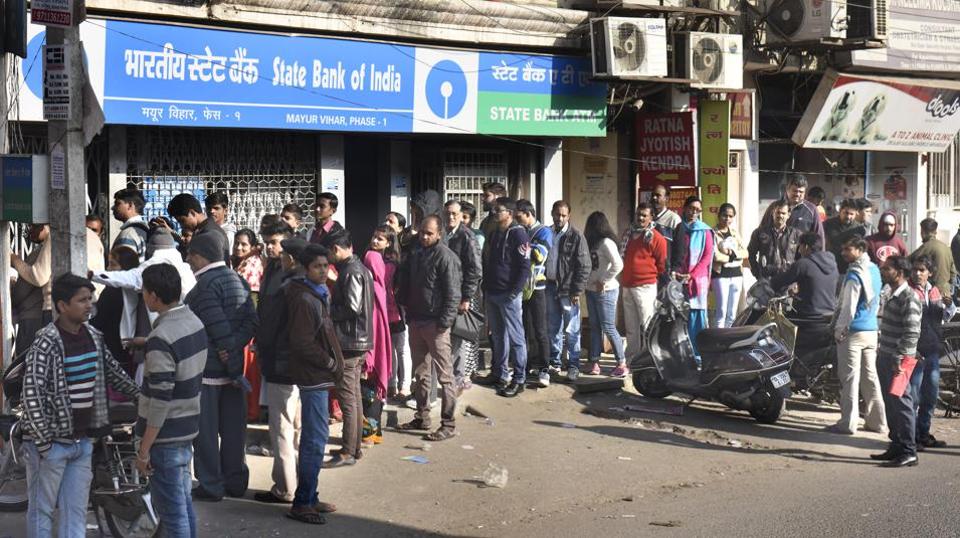

From last few days, people are showing distrust in the banking system. The impact of this distrust is plenty of people are withdrawing their savings from the bank due to which banks are facing losses and also in need of emergency cash. Not only these people are in anxiety to deposit their cash in banks. Due to the cause mentioned above, the NDA government decided to drop the FRDI bill.

FRDI bill is financial resolution and deposit insurance. The main reason behind the dropping up of NDRI bill is the concerns of the bank over the distrust of their customers which were causing harm to the security of the bank.

The reason for dropping FDRI

According to the sources, the main reason behind the dropping up of FDRI bill was, a day ahead protest by union bank employee and state-run insurance company. The protest has occurred on July 14. Due to this protest Department of Economic Affairs was issued the order for withdrawing the Bill.

Moreover, the other reason behind this is people are led to the panic withdrawal of cash from their bank accounts which erodes the public trust for the banking system.

Why are people withdrawing?

The primary reason behind this is, the clause in FDRI bill “bail-in” according to this clause if the bank goes under insolvency some part of the cost is also bear by the general people by deducting some amount from their bank accounts. From this fear, people are withdrawing their money from banks.

Statement official

One of the officers stated that for introducing any bill, cabinet approval is must without this the bill cannot be passed. In the same way for withdrawing the bill cabinet approval is the must.

FRDI bill was introduced last year in August 2017. The bill was referred to the joint committee of parliament. The committee was asked to submit the report on the bill before the end of the monsoon session.

The final reports about the bill are coming out in December, and now the government is in trouble for Loksabha election. As the clauses of the bill cause a negative impact on the general public.

The government also mentioned that the bail-in clause is the last option of the bank. Also, the clause is not for public sector banks.