Paytm Launches Its Payments Bank, Offers 4% Interest Rate And Cashback On Deposits

After PM Narendra Modi’s bold decision of Demonetisation took place, many people were left baffled not knowing how to make transactions to buy or sell anything. Even banks also announced a rise in transaction charges and allegations on ATM withdrawals.

Thus, people have had only one option i.e. digital payment option and wallets for their transactions. Here is one more good news for the users who are depending on digital wallets especially Paytm for their transactions.

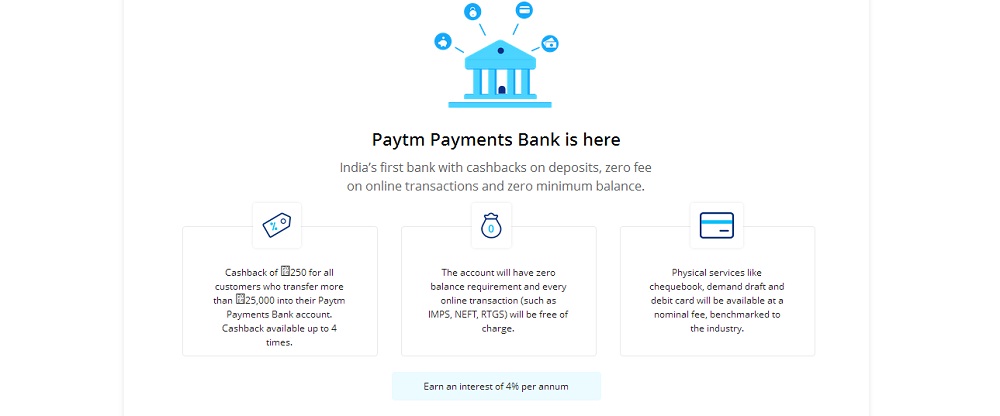

India’s largest digital wallet player Paytm has opened its payments bank. Starting operations on Tuesday, the Paytm Payments Bank will be the first bank to offer cash back on deposits, zero fees on online transactions and no minimum balance. Paytm’s target was 500 million customers by 2020.

Renu Satti, the first CEO of Paytm Payments Bank added, “We are very excited to launch Paytm Payments Bank and bring financial services to the unbanked segment of Indians. Our ambition is to become India’s most trusted and consumer-friendly bank. Leveraging the power of technology, we aim to become the preferred bank for 500 Million users by 2020.”

Vijay Shekhar Sharma stated, “RBI has given us an opportunity to create a new kind of banking model in the world. We are proud that our customer deposits will be safely invested in government bonds, and be used for nation-building. None of our deposits will be converted into risky assets.”

One97 Communications, the parent company of Paytm received permission from the Reserve Bank of India to formally launch the Paytm Payments Bank in January 2017.

Every customer who opens a Payments Bank account will get a cashback of INR 250 as soon they bring deposits of a total of $387(INR 25K) in their bank account Also, customers will be given zero charges on all online transactions (such as IMPS, NEFT, RTGS) and no minimum balance requirement. For savings accounts, the company would also offer an interest of 4% per annum.

Initially, Paytm Payments Bank accounts will be available on an invite-only basis. In the first phase, the company will roll out its beta banking app for employees and associates. Paytm customers can request an invite by going to www.PaytmPaymentsBank.com or on the Paytm iOS app.

Paytm is hoping to replicate this success in the banking sector and further drive cashless transactions with the Paytm Payments Bank. The current Paytm Wallet will move to the Paytm Payments Bank in the same capacity, i.e. KYC Wallet as KYC Wallet and minimum detail KYC Wallet as minimum detail KYC Wallet, a development that was reported back in December 2016. Users will continue to be able to use their Paytm Wallet in the same manner as before.

Paytm plans to roll out 31 branches and 3,000 customer service points of the bank in the first year. Paytm will offer virtual Rupay debit cards to customers immediately and physical card on request for withdrawing cash from any ATM in the country.

In the coming few months, as Paytm shifts focus onto the Payments Bank and away from digital wallet, e-commerce behemoth Amazon that secured a licence from the RBI to operate a prepaid payment instrument (PPI) is expected to launch a wallet while instant messaging app WhatsApp is expected to launch a peer-to-peer payment system in India, within the next six months.