GST Explained In Layman’s Terms! How It Is Going To Benefit Common Man And Save Middle Class People From Cascading Effects? Everything In Detail

India’s most awaited tax reform ‘Goods and services Tax Bill’ is on the table. This historic bill will be implemented from today. With the game-changing tax imposition on all the goods attesting with four-way tax slabs, GST is well appreciated, yet criticized step taken by Central Government.

Earlier, Union Financial Minister Arun Jaitley firmly stated that implementation of GST along with demonetization will add bigger progress to the Indian economy, arresting concerns from a certain section of industry and political parties on its long-term impact on the economy.

In his words: “Demonetisation plus GST means bigger economy and higher and better GDP.”

He said both the moves will lead to a cleaner tax system in the country. It was assumed that in order to sweet coat the pain demonetization has left, the idea of linking the same with GST was done. But coming to the facts, after going through the below explanation, one will definitely be able to understand the propaganda, implementation consequences and long-term benefits exclusively.

Firstly, What is GST?

In our day to day life, we, the citizens of India pay two kinds of taxes. The first one being the ‘Direct tax’ that is paid to the government in the form of ‘Income Tax’, the second is ‘Indirect taxes’. GST is not going to lay its shadow on the former one, while, the whole effects can be noticed on the latter.

Goods and Services Tax, generally called as GST, is a multi-staged and comprehensive bill. This is a consumer favorable bill rather than the manufacturer. In a single word, one can call GST, a Destination-Based. Goods and Services Tax will be levied on all transactions happening during the entire manufacturing chain, but the taxation will be exclusive and none will pay extra, no cascading effect.

This tax is imposed through four varying slabs: 5%, 12% , 18%, and 28%. The range of imposition depends on the price and value of the service in the current day market. For basic amenities, there’ll be 5% tax imposition, meanwhile, for luxurious hotel services and aeroplane tickets it will hit 28%.

Must Read: Impact Of GST On Basic Household Items And Their Tax Structure

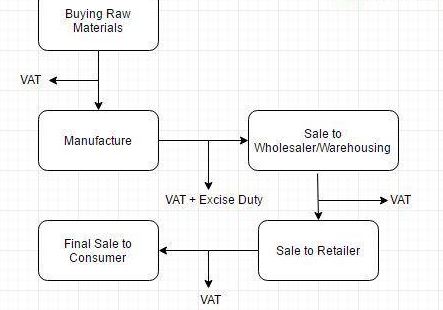

Until now, the process of taxing is as follows:

In every stage of the sale, a general tax of 10% is added to the cost price and value added, this thread will be carried forward from Raw materials to Manufactures, to Warehouses, to Retailers, then to Consumers. Here, the tax will be levied on every buyer with a 10% cumulative.

From Now onwards, taxing will be replaced with GST format, as follows:

In the earlier process, the purchaser is paying an assumed 10% of tax at every stage, which causes the ‘cascading effect’, because of which, the seller has to charge extra tax in order to recover his payments. With the implementation of GST, the purchaser will not be charged even a penny extra, with the flowing stages, the tax payment will be reduced, that 10% will be there, but the amount purchaser has to pay is so little, subtracting the actual tax minus the tax paid by the seller.

Observe the following table that depicts the tax and product flow:

Table source: Cleartax

Categories in GST:

GST is primarily divided into three main categories,

(Central Goods and Services Tax) CGST: where the revenue will be collected by the central government

(State Goods and Services Tax) SGST: where the revenue will be collected by the state governments for intra-state sales.

(Integrated Goods and Services Tax) IGST: where the revenue will be collected by the central government for inter-state transactions.

In most cases, the tax structure under the new regime will be as follows:

| Transaction | New Regime | Old Regime | Comments |

| Sale within the state | CGST + SGST | VAT + Central Excise/Service tax | Revenue will now be shared between the Centre and the State |

| Sale to another State | IGST | Central Sales Tax + Excise/Service Tax | There will only be one type of tax (central) now in the case of inter-state sales. |

How is GST going to help the common man?

The main aspect of GST is, the absolute waiver in tax, the 10% tax which will be paid in every stage will not be paid in this format. Instead, a new strategy of Input Tax Credit is introduced. It is the credit an individual receives for the tax paid on the inputs used in manufacturing the product. So, if there is a 10% tax that the individual must submit to the government, he can subtract the amount he has paid in taxes at the time of purchase and submits the balance amount to the government and so on.

Prices of all the unpacked food grains such as gur, milk, eggs, and salt will go down, as they won’t attract any tax. Some services like banking and financial services have been put in the 18 percent rate slab which earlier 15 per cent.

Meanwhile, Sandeep Sehgal, director-tax and regulatory at Ashok Maheshwary & Associates LLP was quoted saying, “However, going forward, it is expected that due to reduced cost because of availability of GST credit on items hitherto not available, the price of services will also come down which will benefit the consumers.”

Check here for detailed changes in prices of goods: GST Price Details: List Of Items That Get Cheaper And Expensive From Today After GST Impact

Post-July 1st, many items like footwear below Rs. 500 and garments could become cheaper. On the other hand, items like TV and small cars could become costlier, despite the other changes, Petroleum products such as petrol, diesel and aviation turbine fuel have been kept out of GST as of now. The GST Council will take a decision on it at a later date.

The most promising factor in this new bill is the tax waiver on the basic food items. It is assumed that more than 25 lakhs of Indians are still Below Poverty Line (BPL), they can’t afford to have minimum food amenities, with the implementation of GST, the tax on the food and groceries will be almost nil, subsequently lowering the overall price.

Watch the video for further understanding:

Origin of GST:

France, considered as the pioneer of economic reforms is the first country to rope in GST, though the terminology is different from ours, as VAT is the substitute for GST in other countries, the purpose stands the same. France was the world’s first country to implement GST Law in the year 1954. Since then, 159 other countries have adopted the GST Law in some form or other.