Financial and Banking Sector Regulations and Reforms in India For IBPS Exams

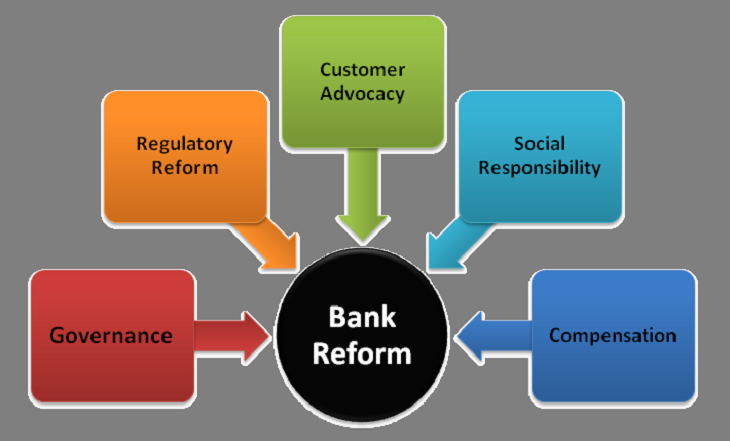

Banking sector reforms were introduced to remove the deficiencies in banking sector. The lack of autonomy is reflected in the fact that there is a common wage package for all bank employees irrespective of the health of the bank concerned. Kannan, the Chief ExecutiveOfficer of Bank of Baroda, says: “Give us the freedom to fix our own wages and offer marketremuneration to professionals. Do not tie us down to a common wage structure. Let each bank decide its appropriate level of wages”. Here we are provided you the list of Financial and Banking Sector Regulations and Reforms in India.

Bank Exam Preparation Guide: Tips and Tricks

Financial and Banking Sector Regulations and Reforms in India:

India has had more than a decade of Financial sector reforms during which there has been substantial Transformation and liberalization of the whole Financial system

Objectives of Financial sector reforms in India.

1. Reforms Financial repression that existed earlier

2. Create an efficient productive and profitable Financial sector industry

3. Enable price discovery particularly by the market determination of interest rates that then helps in efficient allocation of resources

4. Provide operational and function autonomy to institutions

5. Prepare the Financial system for increasing international Competition

6. Open the external sector in a calibrated fashion

Banking and Financial Awareness Material Free Download: CLICK HERE

Narasimham committee report 1991 & 1998

The narasimham committee was set up in order to study the problems of the indian Financial system and to suggest some recommendations for improvement in the efficiency and productivity of the Financial institution

The committee had given the following major recommendations:

1. Reduction in SLR and CRR : The committee recommeded the Reduction of the higher proportion of the statutory liquidity ratio and cash reserve ratio . Both of these ratios were very high at that time. The SLR the was 38.5 percent and crr was 15 percent . This high percentage of SLR and CRR meant locking the bank resources for govt uses. SLR was recommeded to be from 38.5 to 25 percent and CRR from 15 percent and 3.5 percent

2. Phasing out of directed Credit programme : in india since Nationalization directed Credit programmes were adopted by the Government . The committee recommed Phasing out of this programme. This programme compelled banks to earmark their Financial resources for the needy and poor sectors at concessional rates of interest

3. Interest rate determintaion: The committee felt that the interest rates in india were regulated and controlled by the authorities . The committee recommeded eliminating Government controls on interest rates and Phasing out the concessional interest rates for the priority sector.

4. Structural re organizations of the banking sector: The committee recommeded that the actual number of public sector banks need to be reduced. Three to four large banks including SBI should be developed as international banks. Eight to ten banks having nationwide presence should concerntrate in the National and unverisal banking services.

Local banks should concerntrate on region specific banking . Regarding RRBs it recommeded that they should focus on agr culture and rural financing

For Financial and Banking Sector Reforms PDF: CLICK HERE

5. Establishment of the ARF and tribunal: The proporation of bad debts and non performing assets of the public banks and Development Financial institute was veey alarming in those days. The committee recommeded the Establishment of an assets reconstruction fund . This fund would take over the proporation of the bad and doubt ful debts from the banks and Financial institutes. It would help banks to get rid of bed debts.

6. Removal of dual control : The committee recommeded the stopping of this system. it considered and recommeded that the RBI should be the only main agency to regulate banking in india

7. Banking autonomy : The committee recommeded that the public sector banks should be free and autonomous. Banking technology upgradation would thus be easy.

Recent Banking Updates 2014 For IBPS Clerks IV

Narasimham committee report II – 1998

In 1998 the Government appointed yet another committee under the chairmanship of Mrt.Narasimham. It better known as the banking sector committee. It was told to review the banking reform progress and design a programme for further strengthening the Financial system of india the committee focused on various areas such as capital adequacy bank mergers bank legislation,

It submitted its report to the Government in April 1998 with the following recommendations:

1. Strengthening the banks in india

2. Narrow banking

3. Capital adequacy ratio

4. Bank owership

5. Review of banking laws

Apart from these major recommendations the committee has also recommended faster computerization, technology upgradation, training of staff, depoliticizing of banks, professionalism in banking, reviewing bank recruitment etc.

To Download as PDF:

Press CTRL+D right now to bookmark this website. Here you can find all study materials and previous question papers PDF’s for free download. These PDF’s might helped you a lot in preparing for exams. All previous Question papers for SSC, RRB, IBPS, IAS (civils), Groups are available in allindiaroundup.com. In this site we provided all the information about Job notification, Admit cards for exams, Materials and previous question papers for exams, Results declared. Stay tuned for this website for more updates.