The Story Behind The Scenes Of Vodafone, Idea Mega Merger You Should Know

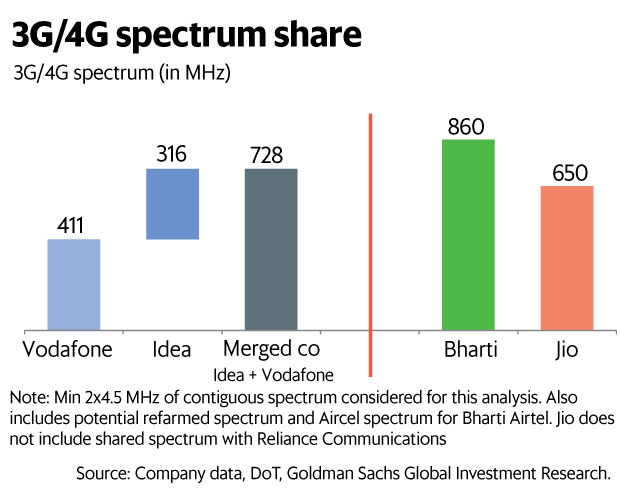

The merger of Idea Cellular and Vodafone holds the potential for significant cost savings and 3G/4G spectrum gain—crucial in market share battle against Reliance Jio and Airtel. With the two companies announcing that Idea Cellular and Vodafone will exist as separate brands after the merger, some analysts are questioning the expected gains from synergies.

The success of the mega-merger between Idea Cellular Ltd and Vodafone India Ltd depends largely on synergy benefits that can accrue by combining operations. While merging companies are typically quite sanguine about synergy benefits, most analysts agree that the Vodafone-Idea merger holds the potential for significant cost savings.

Birla says that there is “great business logic” to the merger. Colao adds that it is the companies’ “vision for the future” that has got them together rather than competition.

“We want to provide valuable service to every India — be it in metros or rural areas. We want to be present in all areas, including transactions and financial inclusion,” Colao said.

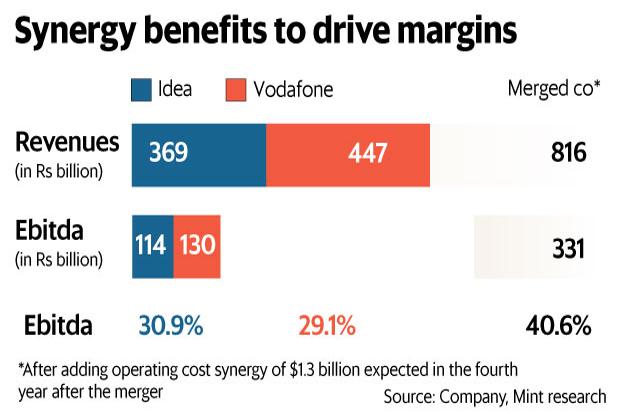

Vodafone and Idea said in a statement that annual savings, both in terms of operating costs as well as capital expenditure, will be around Rs14,000 crore annually by the fourth full year of operations as a combined entity. About two-thirds of this will be on account of savings in operating costs. The net present value of total savings (opex and capex) is estimated at Rs70,000 crore ($10.5 billion).

Opex and capex are short for operating expenditure and capital expenditure, respectively.

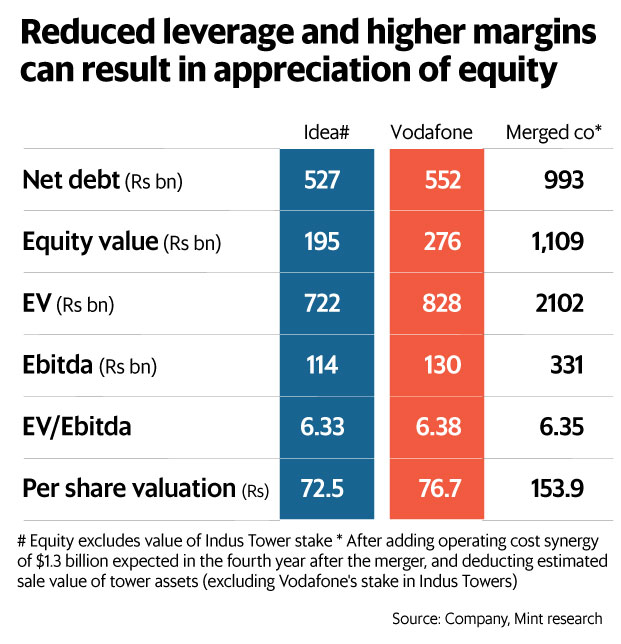

According to a standstill agreement signed by both companies, the merged company’s is valued at ₹946 billion ($14.1 billion) in equity alone.

Nevertheless, a stronger market share in the majority of circles will also result in better efficiency. One of the reasons margins are relatively lower at both Idea and Vodafone is that these companies run EBITDA losses in some circles where market share is sub-optimal.

Idea and Vodafone individually operate at an EBITDA margin of around 30%

With synergy benefits expected to result in higher profits and leverage expected to reduce, the combined entity’s equity valuation is estimated to soar, as the chart below shows.

The two companies have been valued at around 6.35 times enterprise value/Ebitda. Even if we were to assume similar valuations for the combined entity, the estimated increase in Ebitda itself will result in a huge jump in enterprise value.

MARRIAGE OF EQUALS:

It’s never easy when you are trying to combine and create an operation bigger than AT&T’s. More so, when one is bigger than the other. Most back-of-the-envelope calculations had estimated Vodafone India to be worth $3 billion more than Idea, including debt.

Both companies had, on their own, explored buying or merging smaller operations or assets like spectrum from Norway’s Telenor or VideoconBSE 0.29 %, but those talks never fructified. Both sides also had their conditions to make the deal value-accretive for their own set of shareholders. In other words, it had to be a merger with equal rights.

“Both the operations also got valued at the same multiple.” The financial gap between the two has been shrinking in the past few months. “There is only a 10% gap in EBITDA (earnings before interest, tax, depreciation and amortisation) between Idea and Vodafone.

Of the two, Idea has been growing faster and its margins have also improved significantly. So it wasn’t all that tough,” recalled an executive.

The Final Call:

A key issue still to be sorted out was naming the CEO, COO and the CFO.

They finally agreed that Thomas Reistien, CFO of Vodafone India, would continue in his role as would Balesh Sharma, Vodafone India’s newly appointed COO. As for the CEO, they both agreed on a candidate but chose not to announce the name as yet. Many senior Idea officials are on the verge of retirement, making it easier to manage the overlaps.

As an official put it: “We didn’t leave anything to chance for the last minute, but still had to discuss the script… the communication to employees, investors, employees.” As the meeting rolled on till evening, Birla also had to immediately meet and brief some of the board members.

The mega alliance of the airwaves was by then ready to face the world.