HDFC Bank Increases Cash Transaction Fees On Savings Accounts

In a bid to put off cash transactions, India’s second largest private sector lender HDFC bank has raised charges for some transactions undertaken at bank branches. The revised charges are effective from March 1st. Yes, HDFC bank has issued a notification to its customers that they will be levying cash transaction charge March 1st(today).

Latest Update: No Need To Pay Rs. 150 After 4th ATM Transaction

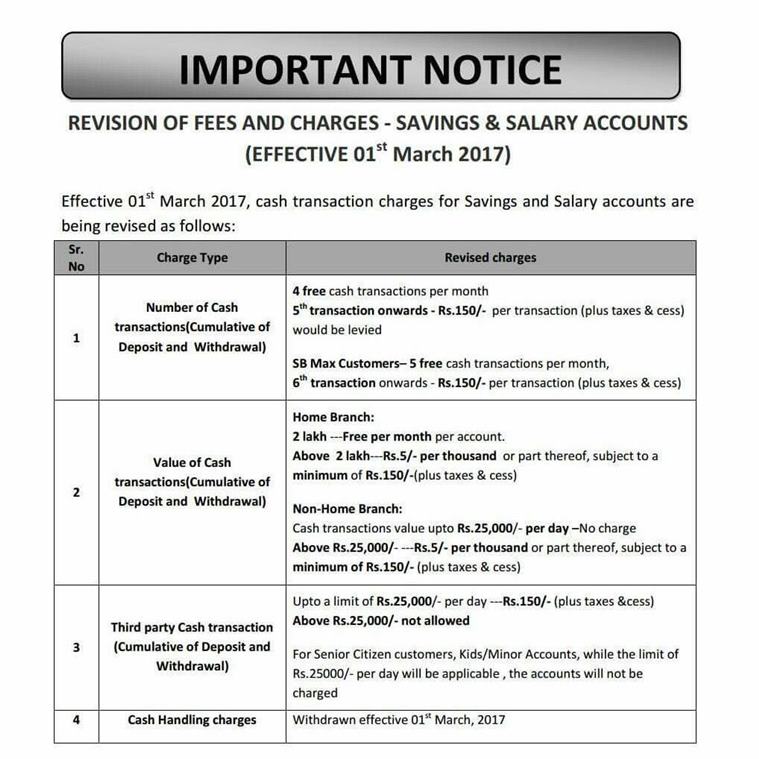

Saving and salary account customers of HDFC Bank will now have only four free cash transactions (which includes both cash deposit and cash withdrawal) per month over the counter at bank branches. For the fifth transaction onwards, the customers will have to pay a minimum of Rs. 150 per transaction (plus taxes and cess).

So if you are an HDFC customer, you can withdraw or deposit total Rs 2 lakh rupees per month per account without any transaction fee. For a non-home branch, the limit is up to Rs 25,000 per day, beyond which charges apply.

The Reserve Bank of India had earlier announced that current withdrawal limits which were announced after demonetization of high-value currency notes from the bank accounts will seize to exist March 13, 2017, onwards.

At the home branch of HDFC Bank, if the cumulative cash transactions (deposit/withdrawal) exceed Rs. 2 lakh, a transaction charge of Rs. 5 per thousand or Rs. 150 (plus taxes and cess) whichever is higher will be levied.

For example, if a customer withdraws Rs. 2 lakh from an account in four transactions and goes for another fifth transaction of Rs. 50,000 from the home branch, then the customer will have to pay charge of Rs. 1,250. (The cumulative withdrawal including five transactions will be Rs. 2,50,000 and as per the new rule Rs. 5 per thousand will be levied which comes to a total of Rs. 1,250).

From the non-home branch, customers can deposit/withdraw up to Rs. 25,000 per day without any charge but any deposit/withdrawal from the non-home branch above Rs. 25,000 will attract charges of Rs. 5 per thousand or Rs. 150 (plus taxes and cess) whichever is higher.

For third-party cash transactions, the bank will now accept only up to Rs. 25,000 per day with a charge of Rs. 150 (plus taxes and cess). Transactions above Rs. 25,000 will not be allowed.

For senior citizens and minor accounts, the limit of Rs. 25,000 per day will be applicable but the accounts will not be charged.