Govt is on the urge to sell a portion of its stake in IDBI Bank to LIC

Recently, the government is working on a proposal according to which govt will sell a significant portion of its stake in IDBI Bank to Life Insurance Corporation of India. According to the sources, govt has already approached the Insurance Regulatory and Development Authority of India (IRDA) for clearance of this proposal. In order to make this proposal, a successful one IRDAI has already decided to give LIC an exemption from violating the maximum company-specific investment limit.

As per now, the insurance companies can own up to a maximum of only 15 % in a single company. Besides this regulator would ask LIC to bring down its stake in IDBI Bank over a period of five-seven years. According to our sources, this won’t be a point of much concern as IRDAI had already allowed such exemptions in the past.

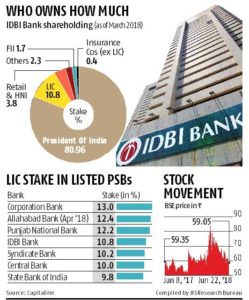

Currently, Life Insurance Corporation of India has an average of 10 percent stake in six PSU banks, including IDBI Bank (see table). And its stake ranges between 9.5 and 10 percent respectively. Besides this, the government held an 80.96 percent stake in the beleaguered bank, and LIC 10.82 percent, as on March 31, 2018.

This news has already alarmed the market on Friday. IDBI Bank’s stock scaled an intra-day high of Rs 61 before closing 2 percent higher at Rs 59 per share on the BSE. The buzz in the market was all about that the government can sell a maximum of 40 percent in the bank to the country’s largest life insurance company. And if such a move by the bank becomes productive than the state-owned life insurer will be holding a majority stake in the ailing public sector bank. The buyout will cost LIC about Rs 100 billion, based on the Rs 248 billion market capitalization of IDBI Bank, as on Friday, and assume it acquires a 40 percent equity stake from the government.

One of the sources said that “Due to lack of any immediate benefits for the bank, Market experts are not excited by this news as of now.

Regarding the deal, G Chokkalingam, founder and managing director, Equinomics Research & Advisory said that “The deal is not beneficial for either of the parties. Given the negative adjusted book value (net worth minus bad loans) of IDBI Bank, the deal is not good for LIC. Also, the bank is not going to get any capital infusion with this. Only government will get some amount,”