On Father’s Birthday, Mukesh Ambani Gives Anil Ambani Rs 23,000 Crore

Reliance Communications (RCom), the telecom company led by business tycoon Anil Ambani has shut down its 2G operations from November 30. As the company is debt-ridden, the authorities decided to pull the brakes on its 2G mobile business and show the door to several of its employees.

The company has cited cut-throat competition in the sector, especially services from a new entrant. Blaming among other factors, the ‘creative destruction’ brought in by Reliance Jio’s free voice and cheap data services.

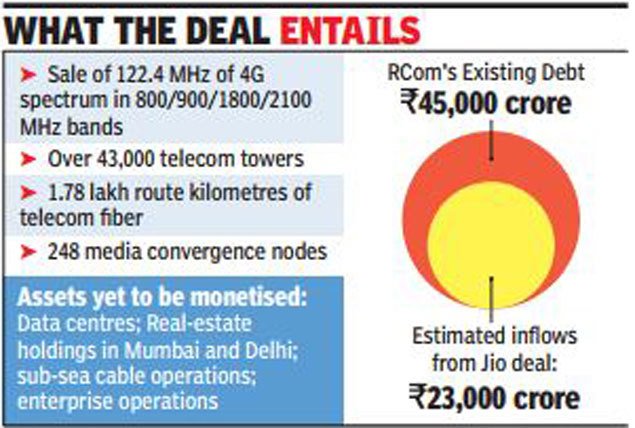

Mukesh Ambani-owned Reliance Jio Infocomm (RJio) has agreed to buy wireless spectrum, towers, and fiber from younger brother Anil Ambani’s firm Reliance Communications (RCom) which is reeling under high debt. While the two companies did not disclose the deal size, banking sources pegged the transaction valued at Rs 24,000-25,000 crore.

Both the companies have signed a binding definitive agreement and the transaction is expected to close in a phased manner in January-March 2018, RCom said in a statement. Consequent to the agreement, Jio or its nominees will acquire assets under four categories, towers, optic fiber cable network, spectrum, and media convergence nodes (MCNs) from RCom and its affiliates, the telecom unit of RIL said.

The announcement comes just two days after Reliance Communications, promoted by Anil Ambani – disclosed a new deal with the lenders under which nearly Rs 40,000 crore will be raised through the sale of assets, averting an imminent takeover by the 35 local and foreign banks.

RCom worked closely with all lenders and SBI Capital Markets Limited, the advisors appointed by the lenders, to run a competitive process for the monetisation of its valuable assets, comprising 122.4 MHz of 4G spectrum in the 800/900/1800/2100 MHz bands, over 43,000 towers, 1,78,000 RKM of fiber with pan India footprint, 248 Media Convergence Nodes, covering nearly 5 million sqft used for hosting telecom infrastructure.

The Jio deal consideration, RCom said, “comprises primarily of cash payment and includes the transfer of deferred spectrum installments payable to the telecom department (DoT)”. RCom said Jio had emerged as the highest bidder in a transparent process conducted under the supervision of a high-powered bid evaluation committee, comprising experts from banking, telecom, and law.

The mega-deal also coincides with the 85th birth anniversary of Reliance founder Dhirubhai Ambani. Shares of Reliance Communications surged nearly 35 percent to Rs. 41.77 on Friday after the telecom operator signed the agreement. After the heightened competition in the telecom sector following the entry of Jio, what had made matters worse for RCom was its failure to merge its business with Aircel.

The collapse of the deal – which would have helped it cut its debt by Rs 14,000 crore – had resulted in another highly lucrative tower deal, with Canadian firm Brookfield that was getting in another Rs 11,000 crore, also breaking down. Following the collapse of the two deals, RCom’s business had seen a massive slide, especially with the business running into losses on a near-daily basis.

This was conceded by Anil on Tuesday in a media conference in Mumbai where he also announced a revival plan that triggered a spurt in the company’s scrip, which closed up 32% at Rs 21.3 on the Bombay Stock Exchange the day on Tuesday.