PAN Card Application Form PDF 2018, Correction, 49AA, UTI

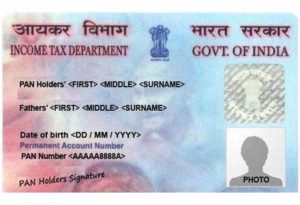

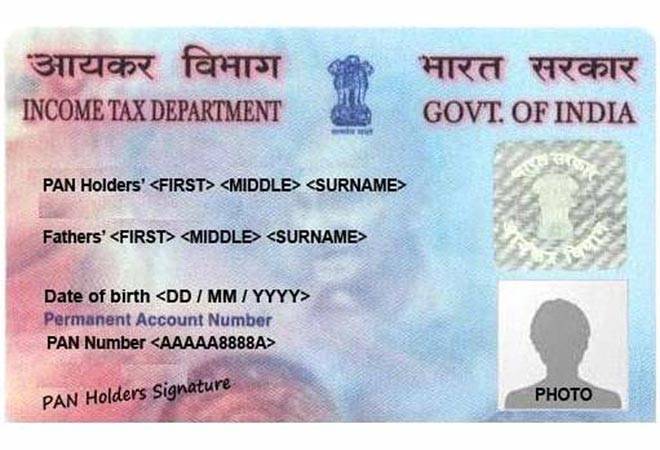

PAN Card Application Form PDF 2018, Correction, 49AA, UTI – The Online Form 49 is well known and extremely famous for PAN Card Registration throughout the nation. Precisely it is 49A, and Government of India in headlines describe it as “Form No. 49A Application for Allotment of Permanent Account Number [In the case of Indian Citizens/Indian Companies/Entities incorporated in India/ Unincorporated entities formed in India] See Rule 114.” There are more than hundreds of things that need to be entered to successfully and completely fill up the PAN Card Online Application Form.

PAN Card Application Form PDF 2018, Correction, 49AA, UTI

Click Here for Direct Link of Download PAN Card Application Form PDF 2018, Correction, 49AA, UTI

Apart from that, all the major contact details of the NSDL e-Government of PAN Card making industry are available such as www.tin-nsdl.com as official website, 020-27218080 as Call Center Number, [email protected] as Email ID, INCOME TAX PAN SERVICES UNIT (Managed by NSDL e-Governance Infrastructure Limited), 5th Floor, Mantri Sterling, Plot No. 341, Survey No. 997/8, Model Colony, Near Deep Bungalow Chowk, Pune – 411 016 as Address and SMS NSDLPAN

Candidates still facing any issues related to PAN Card Application Form PDF 2018 can comment their questions below. Apart from that, at the end of above-given notification PDF, the only couple of details related to Income Tax Department are available like, the name of the official website which is www.incometaxindia.gov.in and Calls contact number that is 18001801961. For more authentic updates and latest news related to Code that acts as an identification for individuals, families and corporates, especially those who pay Income Tax – Permanent account number such as PAN Card Application Form PDF 2018, Correction, 49AA, UTI, please make sure to go through below provided links of ALLINDIAROUNDUP news portal –

- One More Good News From Modi Government To All Those Who Don’t Have Pan Card!

- IT Dept Has Deactivated 11.44 Lakh PAN Cards Till Now, Check Out Here If Yours Is One Of Them

- Revenue Dept To Invalidate The PAN Cards That Are Not Linked To Aadhar, Deadline To Be Announced Shortly

- How To Link Your Aadhaar Card To PAN Card, Step-By-Step Process, And Why Is It Necessary?

- PAN Card Will Be Mandatory For All Bank Account Holders From February 28