GST Bill Procedure And The Things You Should Know About Goods And Services Tax

The Rajya Sabha on Wednesday passed the single most significant economic reform since the liberalization by clearing the GST bill. So, first comes into our mind is What is GST ? And how does it work ?

What is the GST ?

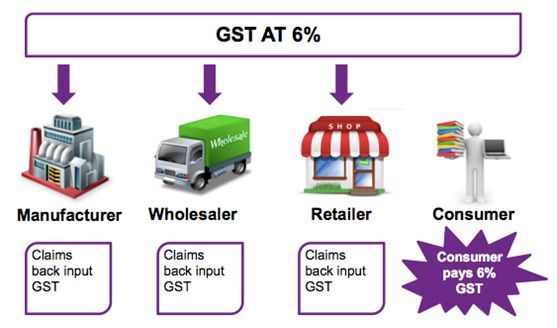

GST is a consumption based tax. The GST is a single indirect tax for the whole nation, which will make India one unified common market. It is a single tax on the supply of goods and services, right from the manufacturer to the consumer.

Credits of input taxes paid at each stage will be available in the subsequent stage of value addition. The final consumer will thus bear only the GST charged by the last dealer in the supply chain. GST is an inclusive tax that will replace current indirect taxation regime. GST will be levied on both goods and services. It will have a dual structure – Central GST & State GST.

Here is what you need to know about the Goods & Service Tax (GST), the taxes it will replace and the benefits that will ensure.

Benefits Of GST:

- It removes multiple taxations

- It creates India as a single market

- Easy compliance

- Uniformity of tax rates and structures

- Removal of cascading

- Improved competitiveness

- Gain to manufacturers and exporters

- Input tax credit will encourage suppliers to pay taxes

- Simple and easy to administer

- Better controls on leakage

- Increase in Government Revenues

- Less compliance and procedural cost

- Higher revenue efficiency

- GST will replace 17 indirect tax levies and compliance costs will fall

- Single and transparent tax proportionate to the value of goods and services

- Relief in overall tax burden

Disadvantages of GST:

- The Tax on services would go up substantially from 14% to 20%

- Tax on retails would be almost double.

- Imported goods would be taxed at higher rate by around 6%

- Small businesses may find it difficult to use the system

Making GST into effect will benefit the consumers by reduced prices of some commodities. Consumers will get benefited as the reduced tax burden on goods will get passed on to them. However, the cost of some services may get increased due to GST.

Things Which Gets Cheaper:

- Groceries

- Processed food

- Small Cars

- Two Wheelers

- Car Batteries

- Movie Tickets

- Consumer Electronics (fans, lights, air coolers, water geysers)

- Building Material like Cement Paints etc;

Things Which Gets Costlier:

- Restaurants

- Tobacco Products

- Branded Clothes

- Mobile Phones

- Insurance Premiums

- Air Tickets

GST would replace most indirect taxes in Central and State govt such as :

Central Taxes:

- Central Taxes

- Central Excise Duty

- Service tax

- Customs Duty (CVD)

- Special Additional Duty of Customs (SAD)

- Central Sales Tax

- Central surcharges and cesses

State Taxes:

- Value Added Tax (VAT)

- Octroi and Entry Tax

- Purchase Tax

- Luxury Tax

- Taxes on lottery, betting & gambling

- State cesses and surcharges

- Entertainment tax

- Central Sales Tax

With GST all these taxes will be subsumed. All the stages in a product development will get benefited and the Central govt revenue will be increased when compared to the existing taxes.