You Will Be Shocked To Know What This Man Was Doing When The IT Department Raided His House

PM Narendra Modi’s sudden currency ban left the citizens of India shocked and created a lot of chaos among the people. It has been mainly directed to eradicate corruption and larger good removal of black money income from the country.

Ever since the massive demonetisation drive, Modi government is trying some or the other way to make people declare their undisclosed income(black money) and pay taxes accordingly.

“Worried bout your unaccounted money stashed in a secret hideout in form of demonetized currency notes? You should be worried!”- PM Jan Dhan Yojana Website.

Prime Minister’s Jan Dhan Yojana provides for people to declare their unaccounted income(black money) and pay taxes accordingly thereby ridding themselves of the burden of having to hide (demonetised) notes that are practically worthless.

Here are the four options for Declaring Unaccounted Money:

- Deposit the money in a bank and clearly, explain its origin. They will have to pay the taxes on that money for the year 2016-17, before 31st March 2017.

- If one declares unaccounted money under Pradhan Mantri Garib Kalyan Yojana, they’ll have to pay taxes, surcharge, penalty and 25%of the income for investment in interest-free scheme for 4 years. The government will then grant them immunity and forgo the opening of their past tax assessments.

- One doesn’t declare the income in any way and the Income Tax department detects it and adds it to the person’s IT returns. This way, the person will be spared tax raids.

- Tax raids: If undisclosed money is found during a raid and the possessor accepts it to be theirs, they will have to pay the tax, penalty, and interest on it. And if the person doesn’t accept that the unearthed money is theirs, they face “severe consequences.”

So, like several others, a Delhi-based lawyer, Rohit Tandon, had declared his hidden income worth ₹125 crores on 6th October 2016, reports India Today.

Here is the background of this guy:

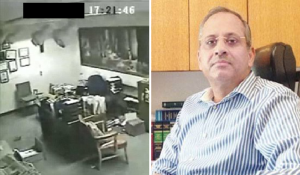

He had bought a house worth ₹100 crore in Delhi’s Greater Kailash-I in July 2014. He founded the T&T Law firm. He has an office inside his home compound and all of his property is fitted with CCTV cameras.

So high-tech security surveillance is the system in his property that it gives out an alert to him, on his phone, whenever anyone switches on any electrical appliance in his house. That’s how he got notified about an ongoing raid on his house while he remained away, according to the Police.

While the Income Tax officials rummaged luggage bags, wall cabinets, boxes and whatnot, Tandon kept a watch on the whole process through his phone. He is currently underground.

The raid had been conducted after days of a close watch on him, his residence and a tip-off about a huge consignment of new ₹2000 notes being delivered to his residence.

“From the premises, new and old currency notes were recovered to the tune of ₹13.65 crore, of which ₹2.62 crore was found in newly introduced notes of ₹2,000,” India Today quoted the Joint Commissioner as saying.

H/t & Image Source: BeingIndian